Raze-or-Retrofit:

Evaluation of Seattle’s Commercial Building Stock for Energy Efficiency

In 2002, Arizona architect Edward Mazria created Architecture 2030, an independent, non-partisan organization to examine the role of commercial development as a response to climate change. Architecture 2030 was developed as a solution; to assist in transforming the commercial building sector into an effort which would increase the efficiency of new construction, and seek retrofitting solutions within the existing building stock.

In 2009, the 2030 Challenge was established, which challenged architects, developers, property managers, planners, governments and other stake holders in the development industry to reduce the carbon footprint of the new and existing building stocks by 2030 to a carbon-neutral level. In Seattle, this effort was furthered by local architect Brian Geller, who in 2009 established the Seattle 2030 District in order to actuate the 2030 Challenge, and bring it home at a local level.

To accomplish this, the Seattle 2030 District teamed up with local architects, developers, planners and city officials to develop a local approach to meeting the goals of the 2030 Challenge. The Seattle 2030 District breaks up the city core into 12 distinct districts, and has created approaches to encourage public-private solutions – both in new construction and in the retrofitting of existing Seattle building stocks.

One problem faced by the the Seattle 2030 District involved the outreach efforts to owners of existing properties. In some cases, property owners were not as likely to be interested in retrofitting their existing structure for energy efficiency, but would more likely want to redevelop the property entirely (thus meeting the new energy code). The existing outreach efforts did not distinguish this group of owners from the others, and as such, a method was needed to segregate the two.

In order to facilitate this effort, my thesis focused on the creation of a tool which would take existing building data, and combine it with data created locally, and then run through an algorithm which would, in the end, derive a score indicating the propensity of that owner to either retrofit their building for energy efficiency, or raze it in favor of redevelopment. I also used several summary case studies to validate the findings, and one in-depth case study to demonstrate the ideal candidate.

The results from this analysis were surprising, and indeed confirmed that there appears to be a correlation between various elements describing real properties, their state, makeup, use and location – in combination with other aspects of development (degree of development, sensitivity of use, type of ownership, etc). When weighted and scored, the results showed reasonable accuracy of such a determination, and it opened the way for further studies in the Master of Urban Planning thesis which followed.

The following images are from the M.Arch thesis, and provide a flavor of some of the discussion. Shown are elements from the historical analysis, some of the evaluation elements, the (broad) scoring results, and case studies which substantiate the final scores.

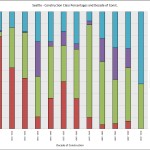

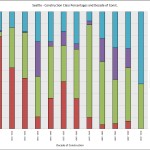

| Historical Analysis: The study began with an analysis of Seattle’s existing commercial and multifamily building stocks; what they currently are and how they came to be. The analysis looked at historical trends in construction in Seattle, and focused on the materials and methods used over the decades.

The result showed the rise and fall of masonry construction within the city, and the change over to structural steel and eventual use of concrete and wood (especially within the multifamily market). |

|

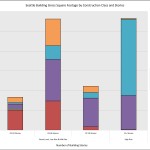

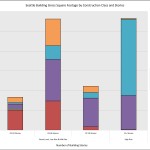

| Baseline Development: From the historical analysis, a baseline was established which uncovered the most common commercial and multifamily building types in Seattle. This analysis sought to understand the differences in building commonality found in the quantity of such buildings, and also in the amount of gross square footage of that type, found within the city.

The result was a surprise in that while one and two story buildings are numerically the most common, the three-to-five story buildings make up the second largest percentage of the city’s building stock (behind the high rises). |

|

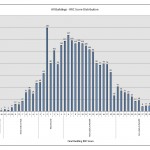

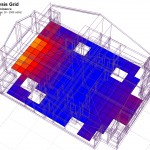

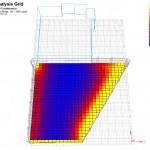

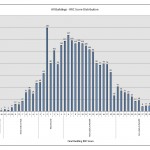

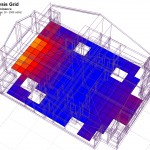

| The Raze-or-Retrofit Continuum: Once the building baseline was established, evaluation criteria were established which would be used in the development of the Raze-Retrofit Continuum (RRC). The RRC is a derived score for each commercial or multifamily property within the Seattle 2030 District which indicates the propensity of the owner to either invest in retrofitting his building for energy efficiency, or raze it in favor of total redevelopment.

To facilitate this, the RRC utilizes a collection of evaluation points (among them: construction class, building age, owner type, use, heating type, land-to-improvement value ratio, value volatility over the last decade, percentage of development envelope utilized, use sensitivity and others) which are themselves weighted and scored based on a host of assumptions.

These scores are then processed through an algorithm to derive a final score of that building on the RRC.The result of the RRC was a distribution curve which showed a majority of the properties fell within the lower scoring “likely” range; indicating that the owners would be moderately likely to retrofit their buildings for energy efficiency.

Of importance were the two extreme ends of this graph – those who would not be retrofitting because the building would either be redeveloped, or because it was too new and was already energy efficient – owners that the Seattle 2030 District could refrain from contacting.

|

|

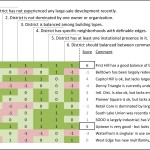

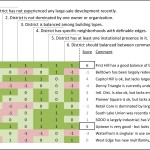

| District Choice and Study Area: The baseline above provided only an outline of the “typical” Seattle building, and additional studies were undertaken to determine other commonalities such as construction method, age, and use. Those elements were then compared across 1100 commercial and multifamily buildings within Seattle’s 2030 District to locate a representative district which contained a similar representative profile, and would eventually serve as the study area.

The districts were examined for this similar profile, and for other influences which potentially could negatively influence the district study and the eventual study area itself. After this review, two districts were found to have the most potential: First Hill and Uptown.After the district was chosen, a study area within that district was established.

The study area chosen sought to contain representative building types and uses while also maintaining a proximity to a major Seattle institution for the upcoming MUP thesis. |

|

| Building Case Studies – Multifamily: Once the study area was established, buildings were chosen within the study area, they were individually analyzed to check the validity of their RRC score; to determine if the scores derived for that property was valid, and why.In the First Hill study are, four buildings were chosen: a multifamily apartment building, a medical clinic, a smaller office building, and a building constructed for doctors offices, re-purposed for retail banking.

1310 Minor Avenue is a typical “five over one” multifamily apartment building that received a negative score of -10.62, which indicates that the owners are more likely to raze the building than retrofit it. When the building and the lot on which it sits are examined, factors are found which indeed make it more likely that the building would not be retrofitted due to the cost and lack of return for the owners.

In this case, the building is lightly constructed with wood framing above the first floor, is lightly insulated, 20 year old double paned windows and uncompetitive unit floor plans and building amenities. While the walls could have an exterior quantity of siding added and the windows replaced to improve the thermal efficiency, it is unlikely due to the ownership of the building, its likely future use and added cost (in absence of good return).

1310 Minor Avenue is owned by the same owners who hold all the other properties on that block, and who also own the large, newly constructed high rise retirement tower there. The rest of the block is also contains an Major Institutional Overlay (MIO) which allows increased high limits and commercial activities.

So, the most likely scenario for the building is that it will continue to provide low cost housing to seniors and will eventually be razed and redeveloped as an addition to the larger retirement project adjacent to it. |

|

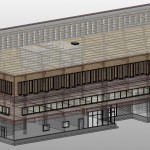

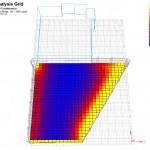

| Building Case Studies – Medical Clinic: The case study at 1145 Harvard Avenue (currently used as the main campus of The PolyClinic) shows another case in point.

In this circumstance, the building under consideration – an addition to a smaller masonry building to its north – was constructed in the very early 1980s with concrete, and rated an RRC score of 14.47, indicating it more likely that the owners would retrofit for energy efficiency rather than razing the building for redevelopment – in 2011.

1145 Harvard Avenue is an addition, with three floors of programmed space and four floors of below grade parking. The primary floor plates of the edition are very deep (100′ at the south end, 200′ at the north end), consisting of post-tensioned concrete slabs. The floor to floor height is only 14′, with an effective ceiling height of 9′.The programming on the main floors center about two central clinical cores, with doctors offices and examination rooms (with opaque walls) around the perimeter.

Because of the depth and height of the floor plates, the post-tensioned and programming, the addition is not a suitable candidate for daylighting strategies (other than skylights on the upper floor). The addition has undergone considerable retrofitting of its physical plant, lighting and HVAC system, however.The most likely scenario for 1145 Harvard Avenue is for the building to continue to operate for another 10-15 years as efficiently as can be achieved, and then eventually be razed for redevelopment of a new structure.

Because of cost of replacement and the difficulties in the floor plate design and construction, it is unlikely they would choose a deep retrofit as a viable option in the near term. |

|

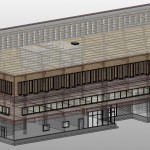

| Building Case Studies – Small Office Building: The case study at 1001 Broadway is a small office building, originally two stories constructed in the 1930s, with a third story addition added in the 1950s. The building sits at the very busy corner of Madison Street and Broadway and is of masonry construction with a timber frame and wood floors.

This building scored a 8.03 on the RRC – a low score which would place it at the low end of the more likely to retrofit – as of 2011 – and rather than raze and redevelop. With masonry exterior walls, a fairly narrow floor plate (45′) and a 15′ floor to floor height, while a number of measures are possible to make this building energy efficient, it is more likely that the building will stay in a holding pattern – for the next three to five years – before it too is redeveloped.

The fate 1001 Broadway, like the other buildings, is determined largely by placement, condition, competitiveness and efficiency. The zoned height limit for this building is 160′, and the vintage floor plan of the building makes it uncompetitive and financially inefficient compared with other office buildings nearby which command much higher rental rates.

In addition, the owners of this building purchased it in early 2008, at a 40% premium over value. Most likely undertaken as an investment property during the First Hill Link Light Rail Station deliberations, this building will have to overcome this temporary decline in value before the demand makes redevelopment viable. |

|

| Building Case Studies – Re-Purposed Retail Space: The case study at 1224 Madison Street is a small retail space (bank branch), re-purposed from it’s original construction as a doctors office and surgical center. Built in the 1920s, this building is comprised of two floors of masonry construction and has been retrofitted to make it energy efficient.

Like the office building at 1001 Broadway however, this retail space is located in the busy Madison Street Corridor, and is woefully underdeveloped for that area. The relatively low RRC score of 7.08 – for 2011 – indicates that while the building is a viable candidate for retrofitting, the fate of the building is more likely to be held for a number of years before razing the site and redeveloping it entirely.

1224 Madison Street is well constructed, has narrow floorplates and high ceilings to encourage daylighting efforts, and a thermally efficient physical plant. The building could become even more efficient than it is currently, however deep retrofits for this property are unlikely.

1224 Madison Street sits within the same NC160 zoning area that 1001 Broadway does. While the building is in a very active development area, its layout and leasable space make it uncompetitive and inefficient. The owner of the property, Key Corporation of Cleveland Ohio, is unlikely to invest the funding needed to complete a deep retrofit on the building.

Key Corporation is more likely to relocate the bank branch to another location and redevelop the site when it becomes financially viable to do so.

|

|

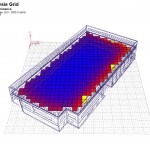

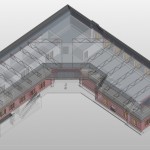

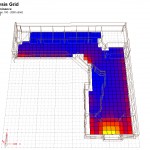

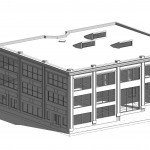

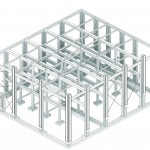

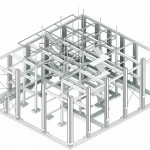

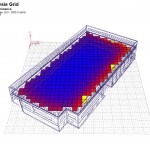

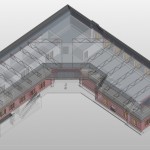

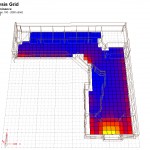

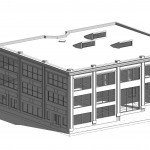

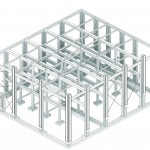

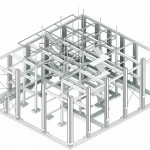

| Primary Case Study – Historic Office/Re-Purposed Space: The case study located at 400 East Pine Street is the primary study done for my thesis, and the one building outside of my study area. The building was included in the study in order to show what options an owner might have when considering deep retrofits for energy efficiency or razing the building for redevelopment.

Built in 1911 as a motorcycle dealership and garage, 400 East Pine Street has seen much of its life with automobiles or motorcycles housed within it (as recently as the 1970s it was a Buick dealership). Constructed of a masonry exterior wall, large 24″ timber frame and 10″ thick solid wood decking for floors, the building is a classic among classics in the Pike-Pine Conservation District, and is a good candidate for an exploration of what may be possible in a response to a deep retrofit.

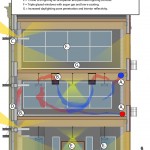

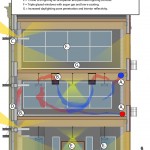

My study proposed that the building not be razed and redeveloped. It suggested that a solidly built building which is only 20′ beneath the zoning height limit actually offers a variety of choices for improvement. Among these suggestions was: A.) move the core back to the center of the building, and use modern technology to decrease heat loads and possibly add photovoltaic cells to the roof. B.) To do what was done in A, plus add a two story penthouse to the roof for either residential or commercial lease. C.) to do both A. and B. and then also take a bite out of the west wall, creating a court yard within, a more unique space, and allowing light to penetrate deep within the building.

As part of these suggestions, I also completed a structural analysis, and looked at the options which would both preserve the existing classic heavy timber frame and still allow for the addition. It was found that the existing frame could support a lightly metal framed two story penthouse, and that the added load would be carried to the foundation.

Under Option C, the penetration into the building was created to open the buildings interior to more light, while at the same time creating an interesting space which would contrast with the original. It was thought that such a space might make the property more competitive with other competing commercial spaces and add to the unique quality of the Pine-Pine Corridor.

Under all options, the building would receive a full replacement of all physical plant and HVAC systems. The new systems would utilize both passive and active processing of ventilation, heating and cooling and reduce the buildings electrical load by leveraging daylight. |

|